The rise of ecommerce has provided incredible opportunities for businesses to reach larger audiences, scale their product lines and generate more revenue, but it also presents unique challenges. Due to its reliance on digital payment processing, ecommerce poses a greater challenge when it comes to determining the identity of online customers. These customers aren’t standing in front of you in a brick-and-mortar store, able to produce a driver’s license to verify who they are; instead, they are inputting identifying information about themselves to make a purchase and relying on electronic identity verification to protect their transactions.

At EVS, we specialize in electronic identity verification—but what exactly does that mean, and why should it matter to your business? The online verification industry often uses technical jargon that grows and evolves rapidly alongside the digital landscape, and if you’re new to the ecommerce world or simply trying to increase your company’s fraud prevention strategies, it can be hard to keep up. To help you understand the basics of electronic identity verification and how they apply to your business, EVS has put together this step-by-step introduction.

What is electronic identity verification?

Electronic identity verification is a detailed process businesses use to authenticate customers’ personal information, both for the protection of the customer and the protection of the business. Personal information could include the customer’s name, address, phone number, email address or date of birth, which is checked by an identity verification system to authenticate a person’s identity. This fraud prevention process helps ensure that customers’ personal and financial information is kept safe and is shared privately between the customer and the intended business. Identity verification is also used to verify employees and other company stakeholders to make sure they are onboarding and conducting business with legitimate people who are not involved in illegal financial activities.

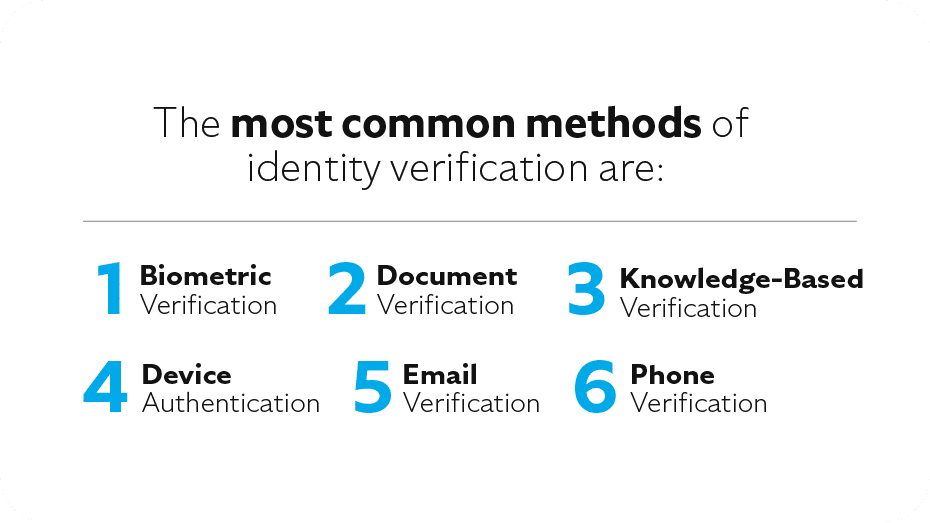

There are several types of electronic identity verification methods to make sure customers are who they say they are. Businesses that want to protect their online transactions often partner with electronic identity verification providers like EVS to determine what identification methods are best for their fraud prevention needs.

Who needs electronic identity verification?

Because cybercriminals have developed such sophisticated and varied methods of stealing identities and infiltrating payment processing, every industry is at risk of identity fraud. To combat fraud attempts, the Financial Action Task Force (FATF) has set international standards for every industry. These standards, often known as Know Your Customer (KYC) and Anti-Money Laundering (AML) laws, are mandatory regulations that can be met using electronic identity verification.

Without identity verification for fraud prevention, cybercriminals will continue to target and attack your business and your customers. While some industries are more likely to be targeted than others, all sorts of online businesses and industries use electronic identity verification, including:

Financial services

Gaming

Education

Healthcare

Retail

When is electronic identity verification used?

Identity verification is run at different times for different businesses, depending on the purpose of verification. Typically, identity verification takes place when a customer is making an online transaction. The verification process can be automated so that the customer experiences a streamlined identity verification process while making their purchases and can feel confident in the security of their online transaction.

Where can my business find electronic identity verification support?

Online identity verification software is provided by professional fraud prevention organizations like EVS, as well as built into your brand’s own website for ease of customer use. EVS offers verification for consumer identities in the US and Canada. Our solutions are tailored to fit your existing policy and integrate directly with your website, so your identity verification process will create a seamless experience for your customers and maintain federal compliance for your business.

Why is electronic identity verification necessary?

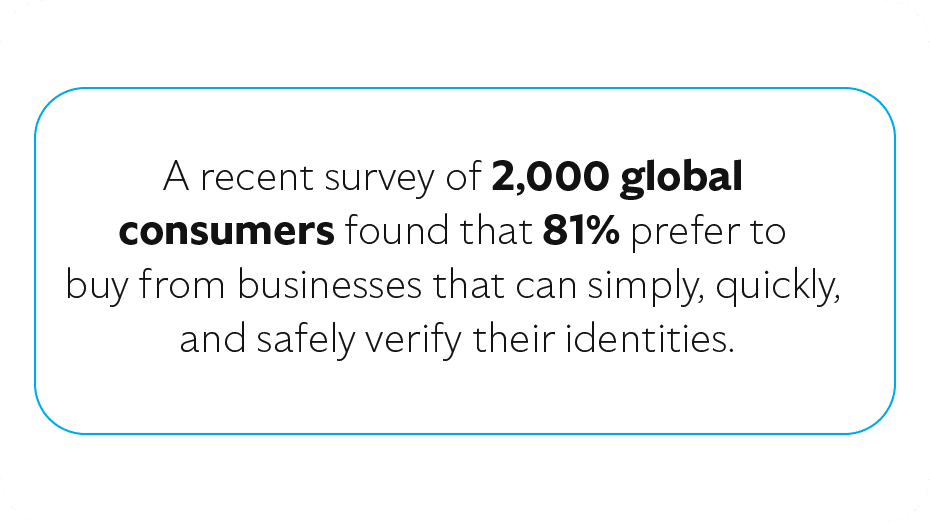

Electronic identity verification is a crucial component of fraud prevention. The goal in electronic identity verification is to prove that customers are genuine individuals instead of imposters. If they are imposters, identity verification can stop fraud before it even happens by stopping the transaction during the payment process. This protects the business from chargebacks and a damaged reputation and protects the real cardholders from theft. Businesses also gain credibility and consumer trust by using a strong electronic identity verification system. A recent survey of 2,000 global consumers found that 81% prefer to buy from businesses that can simply, quickly, and safely verify their identities.

Electronic identity verification is a crucial component of fraud prevention. The goal in electronic identity verification is to prove that customers are genuine individuals instead of imposters. If they are imposters, identity verification can stop fraud before it even happens by stopping the transaction during the payment process. This protects the business from chargebacks and a damaged reputation and protects the real cardholders from theft. Businesses also gain credibility and consumer trust by using a strong electronic identity verification system. A recent survey of 2,000 global consumers found that 81% prefer to buy from businesses that can simply, quickly, and safely verify their identities.

How does electronic identity verification work?

While identity verification can be scaled according to each business’s individual needs, here’s an overview of the basic electronic verification process:

- The customer provides personal information to verify their identity. This can include names, addresses, date of birth and government-issued identity documents.

- Identity verification software takes this information and converts it into data points.

- The software then compares those data points to one or more databases to confirm consistencies or find discrepancies.

- If the data matches, then the customer’s identity is verified.

- If not, it is flagged to the company and rejected. The company is then notified so they can assess the likelihood of fraud, or if it was simply an instance of customer error when inputting identifying information.

Electronic identity verification with EVS

The most effective, efficient way to safeguard your business against fraud is by using a strong electronic identity verification system. EVS provides flexible identity verification solutions that can be customized for businesses of all kinds. Our powerful tools can enhance your brand’s online transaction security through consumer data and document verification, as well as enhance your fraud prevention efforts through fraud alerts and watch list screenings. To discover more about identity verification from EVS and how our comprehensive chargeback prevention tools can help your business, visit our website, or contact us for a consultation.