Money laundering is a serious and expensive problem that is growing more prevalent with the rise of digital banking and cryptocurrencies. Unfortunately, there is no single anti-money laundering, or AML, tactic that can fully protect your business from criminal activity.

You need a wide range of effective tools, each working in harmony, to mitigate risk and keep your company out of harm’s way. One such tool, and a very critical one at that, is KYT.

KYT: One Crucial Tool to Fight Financial Crime

KYT, or Know Your Transaction, is a type of AML program that proactively fights illegal financial activity. KYT is a powerful tool that examines every transaction for suspicious and unusual activity. More specifically, KYT applies highly advanced rulesets to track and analyze customers’ transactions and detect inconsistent behaviors that could indicate financial crime. This sets it apart from KYC, or Know Your Customer, which focuses on verifying the identity of individuals involved in financial transactions.

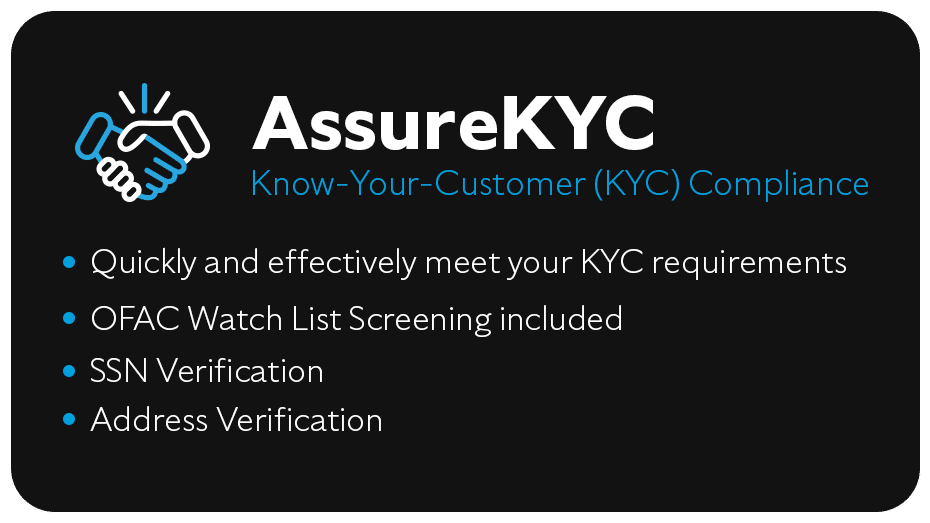

While KYC is useful for identifying and verifying customers, KYT is essential for monitoring and analyzing the transactions themselves. Both tools are crucial components of a successful AML strategy, working together to help fight fraud effectively.

If you’re wondering how imperative a strong KYT really is, take a look at current criminal statistics: According to the US Treasury Department, at least $300 billion is laundered in the US each year, and the UN Office on Drugs and Crime predicts that up to $5.05 trillion will be laundered globally in 2024. Identity theft is now one of the most-used methods of money laundering, and cryptocurrency and NFT laundering also remains a highly lucrative business for cybercriminals.

Money laundering causes a wake of devastation. Banks, other financial institutions, companies, and consumers are all at risk when this type of crime occurs. KYT works to protect the entire financial chain in two ways: by analyzing the data from every financial action that takes place in a client’s account and then identifying possible red flags, suspicious patterns, and discrepancies within transactions. KYC can even alert authorities to suspicious activity and allow them to intervene before the money is successfully laundered.

How KYT Protects Financial Institutions & Consumers

Any association with money laundering can severely damage or even destroy a brand orfinancial institution’s reputation and credibility. Not to mention the jeopardy it can place employees and customers in along the way. A robust KYT strategy not only protects institutions from fraud and enhances the cybersecurity of their financial transactions, but also strengthens their trust with their customers and their employees.

Wondering if your company needs to consider adding KYT to its AML toolbox? A broad spectrum of financial institutions can benefit from (and most definitely need) a strong KYT, including banks, credit unions and credit card companies, fintech and investment companies, online gaming platforms and casinos, and cryptocurrency exchanges. It is also critical to remember that KYT plays a role in maintaining regulatory AML compliance and avoiding federal fines.

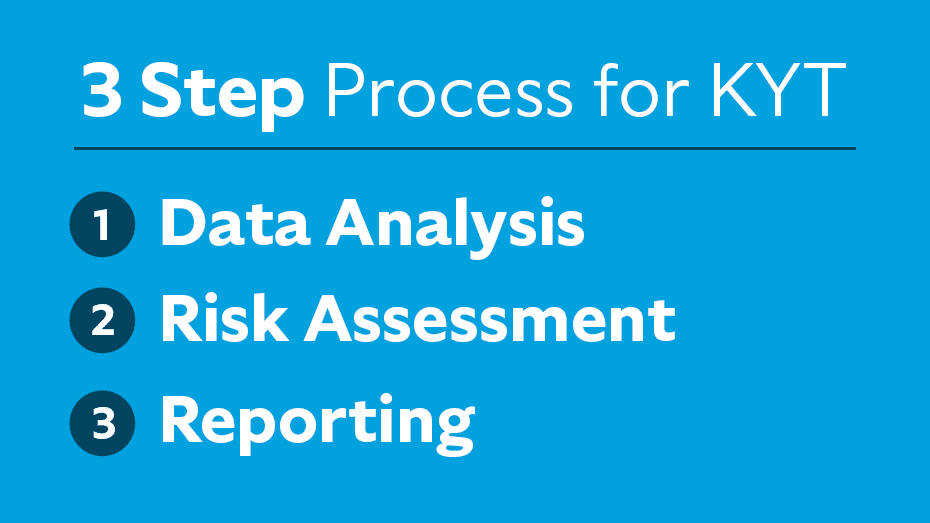

The process of KYT includes three primary steps: data analysis, risk assessment, and reporting. On a practical level, this means that every financial transaction is reviewed for specific criteria (like geographic locations and keywords), investigated if any of the criteria raise red flags or cause suspicion, and reported to the appropriate regulatory channels if financial crime is confirmed.

Leveraging AI to help fight digital advanced criminal activity

Financial services are becoming increasingly digital, and the use of cryptocurrencies continues

to rise as well. At the same time, criminals have become more digitally and technologically

sophisticated, making older transaction monitoring methods less effective.

While it’s easy to see how a well-structured KYT system could improve your company’s risk management and increase the detection of financial crimes, there’s another new factor on the scene that can take your KYT to new levels: artificial intelligence.

AI and machine learning technologies are helping to advance KYT solutions by analyzing

huge amounts of transactions with amazing complexity and speed. When paired with AI, KYT programs now have the ability to leverage machine learning technologies to analyze huge amounts of transaction data in real time.

This gives new KYT tools an extra boost and helps them stay ahead of criminal activity. AI also delivers greater operational efficiency by automating transaction analysis and can increase your company’s customer due diligence by providing additional transaction data points.

How EVS helps prevent fraud and protect your transactions

It’s not enough to simply add any KYT system to your existing AML strategy. With the increasingly sophisticated nature of cybercrime, modern companies need KYT tools that deliver the highest-quality data and the most accurate analyses.

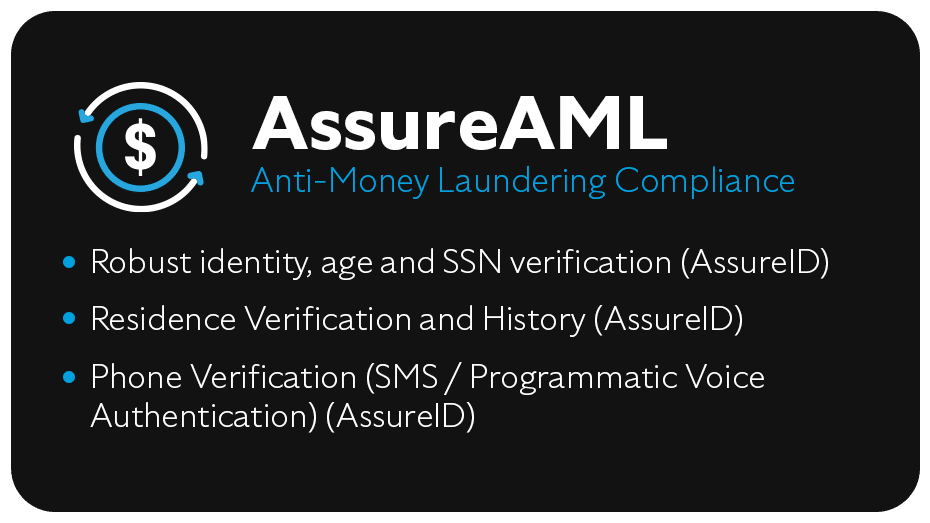

That’s why EVS created our suite of customizable solutions: so you can have total control over all your compliance needs, without compromise. We offer AML and KYC compliance, identity verification, and payment verification solutions, all housed within our BlueAssure cloud platform

EVS has more than two decades of experience preventing fraud for clients in financial

institutions and other complex and highly regulated industries. We’ve processed billions of

transactions through BlueAssure, and we’re one of the industry’s only providers to utilize multiple data sources, returning the most accurate results with the fewest false positives.

BlueAssure helps prevent criminal activity and maintain regulatory compliance – all while providing a fast, frictionless experience for customers and employees. Learn more about BlueAssure and the full spectrum of EVS identity verification solutions by exploring our website or reaching out to our expert team. Create the bespoke solution your company needs with EVS. There’s never been a better – or more critical – time to boost your company’s safety solutions.