The rise of online shopping has opened the world of digital fraud to cyber criminals. While fraud is not a new concept, the tactics and techniques criminals are using continue to evolve. Scammers no longer need access to physical credit cards to take advantage of unsuspecting businesses or consumers, they simply need to steal a small amount of personal information and use it to their advantage to commit credit card fraud.

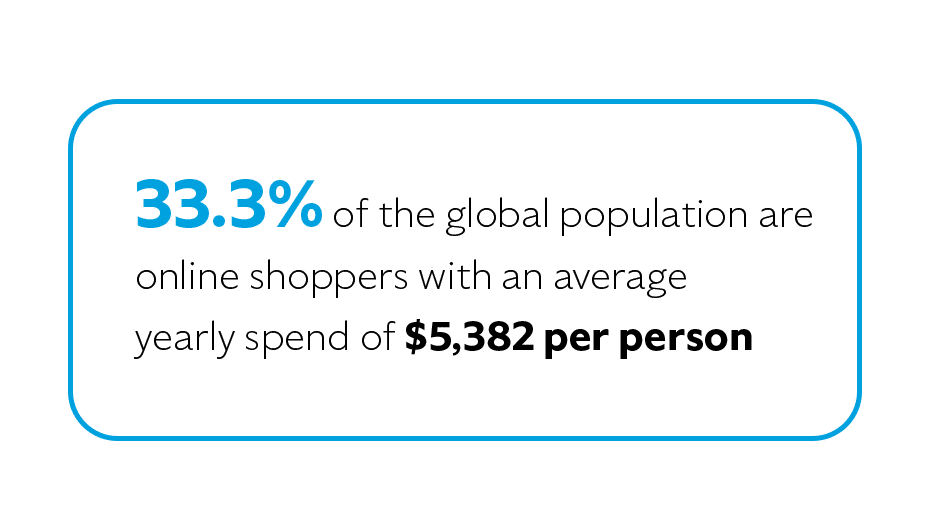

Credit card fraud is the act of illegally purchasing goods or services with stolen consumer information. The threat landscape of credit card fraud is both nuanced and, on the rise, which means that brands and customers alike are being targeted and taken advantage of at ever-increasing rates. In fact, 33.3% of the global population are online shoppers with an average yearly spend of $5,382 per person. And while this is great news for brands looking to start or scale their ecommerce business, the number of fraud victims has also increased 7% in the past year, with 44% of card users reporting repeat credit card fraud charges on their accounts in 2022. With a median fraud charge of $79, this equates to nearly $12 billion in total attempted credit card fraud.

Credit card fraud is the act of illegally purchasing goods or services with stolen consumer information. The threat landscape of credit card fraud is both nuanced and, on the rise, which means that brands and customers alike are being targeted and taken advantage of at ever-increasing rates. In fact, 33.3% of the global population are online shoppers with an average yearly spend of $5,382 per person. And while this is great news for brands looking to start or scale their ecommerce business, the number of fraud victims has also increased 7% in the past year, with 44% of card users reporting repeat credit card fraud charges on their accounts in 2022. With a median fraud charge of $79, this equates to nearly $12 billion in total attempted credit card fraud.

Types of Credit Card Fraud

Born out of its extreme profitability for criminals, credit card fraud comes in many shapes and forms. Criminals are often able to leverage multiple types of fraud to inflict maximum damage on brands and consumers. Because credit card fraud can take place in many forms, including via phone, email, text, or data breaches, we are discussing the five most common types of credit card fraud afflicting businesses in 2023.

1. Card-Not-Present (CNP) Fraud

Card-Not-Present fraud occurs when criminals gain access to a cardholder’s card number and personal information to make purchases online or over the phone. Because businesses will typically assume that online purchases are legitimate and there is no physical card to examine, CNP fraud can be difficult to prevent without specialized security tools that allow merchants to verify consumer identities. To make matters worse, cardholders will report these false charges, forcing businesses to issue refunds and lose products, money, and consumer trust.

2. Credit Card Application Fraud

Credit card application fraud happens when scammers steal and use a cardholder’s personal information (name, address, birthday, social security number, etc.) to create new accounts and apply for new credit cards in the cardholder’s name. Criminals can rack up thousands of dollars of debt on this card over an extended period, and cardholders might only find out about this fraudulent card when they apply for a new credit card themselves or run a credit check. Credit card application fraud can severely damage a cardholder’s credit score.

3. Account Takeover

Account takeovers are sneaky attempts by criminals to not only steal the personal information of their victims, but to also contact credit card companies masquerading as the cardholder. and change passwords and PIN numbers to take over the account. Unbeknownst to the cardholder, criminals often use account takeovers to change PINs and passwords, and the fraud can continue until the cardholding victim tries to use their card and gets declined.

4. Credit Card Skimming

When customers use credit cards at ATMs, stores, gas stations or any physical location, they run the risk of credit card skimming attacks. Credit card skimming occurs when criminals secretly attach devices to credit card readers. The devices steal card information from the magnetic stripping on the backs of credit cards, which the criminals then sell or use themselves.

5. Lost or Stolen Cards

Though this type of fraud doesn’t occur digitally, lost, or stolen cards still make up a substantial portion of credit card fraud. Lost or stolen card fraud happens when criminals steal physical credit cards and use or sell them for their own profit. Cards can be stolen via pickpocketing, intercepting new or replacement cards in the mail, picking up dropped cards or retrieving lost cards under false pretenses.

Credit card fraud is multifaceted, which means that protective measures need to be equally diverse and robust. Many well-intentioned brands use outdated or suboptimal security tools and hope for the best, but many businesses simply don’t have access to security measures sophisticated enough to deter and stop criminals. Modern scammers are constantly inventing new ways to steal credit card information, and making sure your brand is as protected as possible should be a top priority.

Though you can never become fully immune to credit card fraud, there are choices you can make to minimize the risk to both you and your customers. Growing businesses need to protect their investments and their customers with the best security systems possible so that attacks can be detected and stopped before they occur.

Though you can never become fully immune to credit card fraud, there are choices you can make to minimize the risk to both you and your customers. Growing businesses need to protect their investments and their customers with the best security systems possible so that attacks can be detected and stopped before they occur.

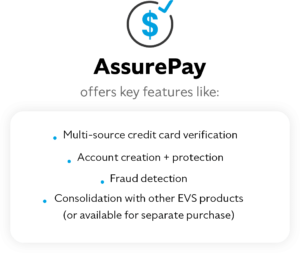

To provide multi-layered protection to our customers, Electronic Verification Systems has developed AssurePay, a highly effective security tool to strengthen brands’ online safety by verifying card information and consumer data at the very beginning of the payment process. AssurePay helps your business prevent and intercept criminals before they can damage your profits, your customers and your reputation. If your business is searching for revolutionary new fraud prevention tools, request a demonstration with an EVS representative today!