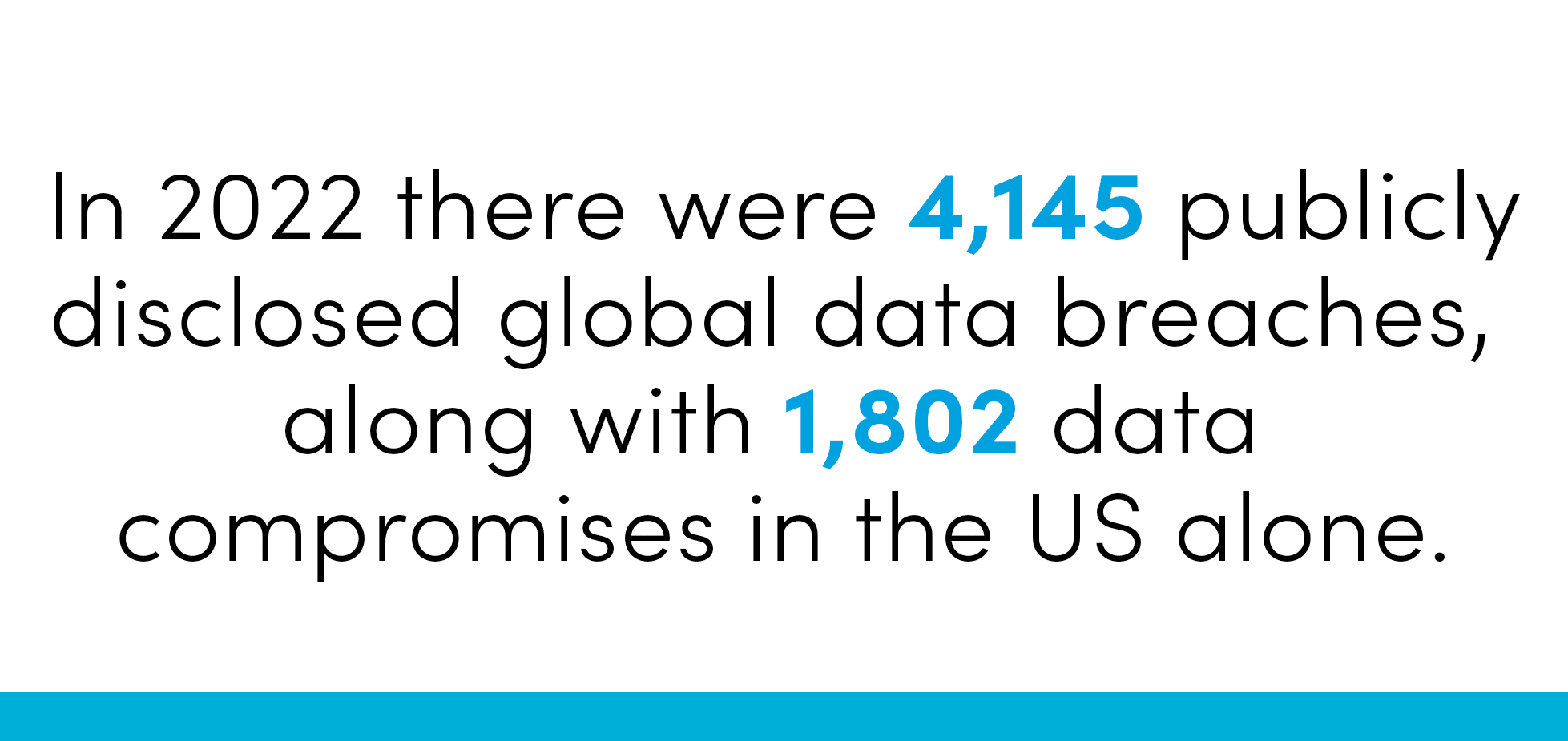

From online bank transactions to in-app purchases, today’s consumers are constantly asked to verify their digital identities, and for good reason. Digital identities are electronic proofs that a consumer is who they say they are, and safeguarding these digital identities is critical. But in today’s digital landscape, it is not enough to employ single-factor or even two-factor identification measures. When personal information entered online can be hacked and stolen in a variety of ways, digital identities must be protected with an equally effective variety of security measures. In 2022 there were 4,145 publicly disclosed global data breaches, along with 1,802 data compromises in the US alone. This risk of data breaches and exposed records means that businesses need to make fraud prevention and identity verification a priority, both for their own safety and for the safety of their customers.

From online bank transactions to in-app purchases, today’s consumers are constantly asked to verify their digital identities, and for good reason. Digital identities are electronic proofs that a consumer is who they say they are, and safeguarding these digital identities is critical. But in today’s digital landscape, it is not enough to employ single-factor or even two-factor identification measures. When personal information entered online can be hacked and stolen in a variety of ways, digital identities must be protected with an equally effective variety of security measures. In 2022 there were 4,145 publicly disclosed global data breaches, along with 1,802 data compromises in the US alone. This risk of data breaches and exposed records means that businesses need to make fraud prevention and identity verification a priority, both for their own safety and for the safety of their customers.

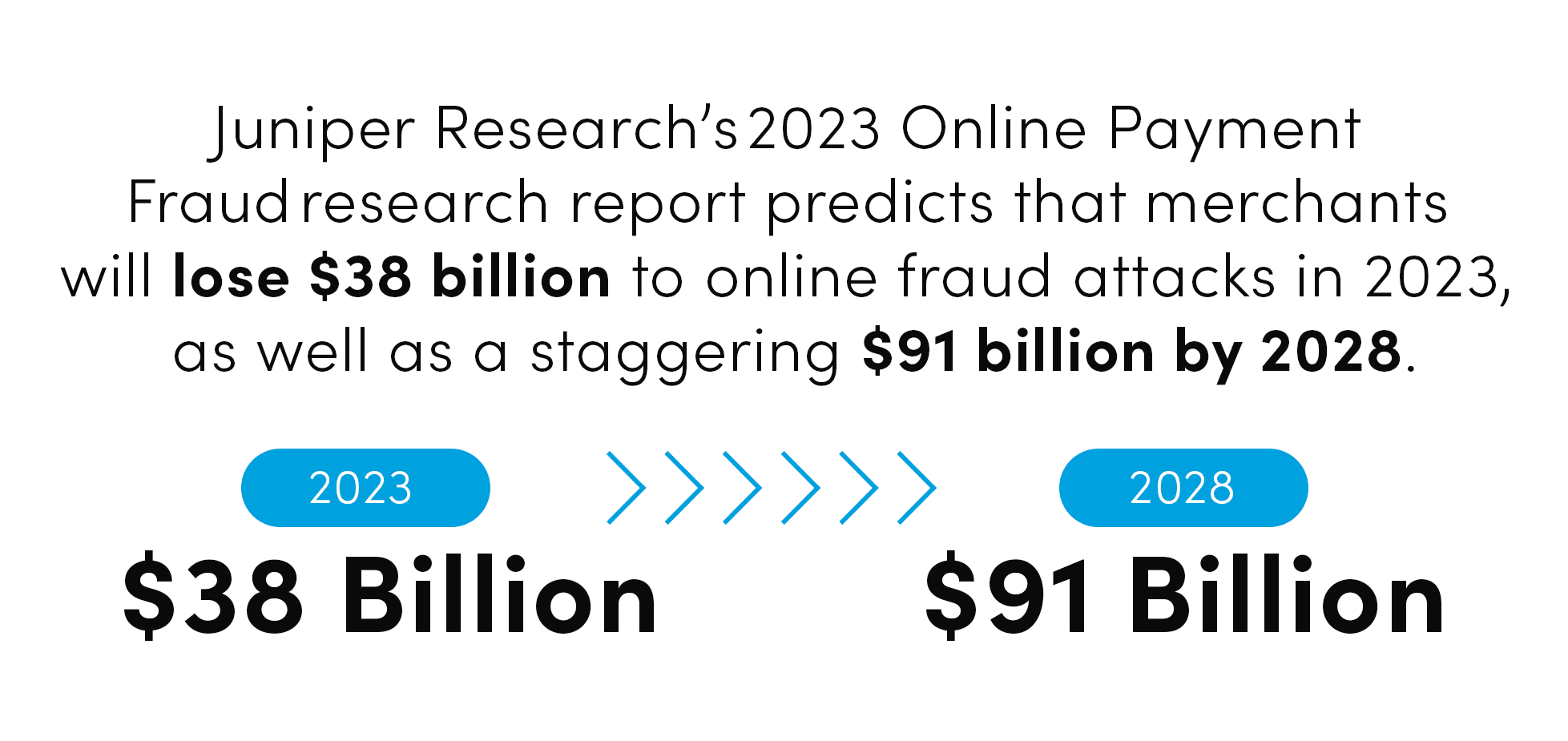

The continued rise of cybercrime and fraudulent activities has underscored the critical need for robust security measures. Juniper Research’s 2023 Online Payment Fraud research report predicts that merchants will lose $38 billion to online fraud attacks in 2023, as well as a staggering $91 billion by 2028. Protecting digital identities is paramount, as hackers continuously find innovative ways to exploit vulnerabilities and gain unauthorized access to personal information. Staying vigilant against phishing attempts and social engineering tactics, in addition to requiring strong and unique methods of digital identity verification, is essential to securing online accounts, mitigating risks, and protecting digital identities from deceptive cybercriminals. Fortunately, there are effective fraud prevention strategies available. In this article, we will explore the power of multi-factor authentication and verification techniques that can be used to effectively secure digital identities.

The continued rise of cybercrime and fraudulent activities has underscored the critical need for robust security measures. Juniper Research’s 2023 Online Payment Fraud research report predicts that merchants will lose $38 billion to online fraud attacks in 2023, as well as a staggering $91 billion by 2028. Protecting digital identities is paramount, as hackers continuously find innovative ways to exploit vulnerabilities and gain unauthorized access to personal information. Staying vigilant against phishing attempts and social engineering tactics, in addition to requiring strong and unique methods of digital identity verification, is essential to securing online accounts, mitigating risks, and protecting digital identities from deceptive cybercriminals. Fortunately, there are effective fraud prevention strategies available. In this article, we will explore the power of multi-factor authentication and verification techniques that can be used to effectively secure digital identities.

Why Multi-Factor Authentication Matters

Multi-factor authentication (MFA) adds an extra layer of security to digital identity verification by requiring multiple forms of verification, significantly reducing the risk of unauthorized user access. Whereas traditional authentication involved the use of a single identifying factor, multi-factor authentication goes beyond the traditional username-password combination by adding additional layers of security to the authentication process. It typically involves the use of two or more of the following factors: something you know (such as a password), something you have (such as a smartphone or token), or something you are (such as fingerprints or facial recognition). Employing multiple identification factors provides a robust defense against account breaches. In fact, Microsoft states that requiring MFA can reduce the risk of digital identity compromise by up to 99.9% as compared to passwords alone.

Multi-factor authentication (MFA) adds an extra layer of security to digital identity verification by requiring multiple forms of verification, significantly reducing the risk of unauthorized user access. Whereas traditional authentication involved the use of a single identifying factor, multi-factor authentication goes beyond the traditional username-password combination by adding additional layers of security to the authentication process. It typically involves the use of two or more of the following factors: something you know (such as a password), something you have (such as a smartphone or token), or something you are (such as fingerprints or facial recognition). Employing multiple identification factors provides a robust defense against account breaches. In fact, Microsoft states that requiring MFA can reduce the risk of digital identity compromise by up to 99.9% as compared to passwords alone.

No digital system, regardless of the number of verification factors, is unhackable. In fact, experts agree that most cyberattacks that could infiltrate single-factor authentication can also be used to attack multi-factor solutions. The benefit of MFA is that it is much more difficult for cybercriminals to access multiple identifying factors and much more unlikely that their skills and attempts will be successful. Household brands like Google as well as small businesses and websites are taking advantage of the fraud prevention protections MFA has to offer.

Types of Multi-Factor Authentication and Verification

You can increase your business’s fraud prevention strategies by staying up to date on the latest types of multi-factor authentication available in the ever-evolving technology landscape. The more MFA factors you can layer into your system, the more robust your security will be. Let’s look at the 5 types of authentication factors your business could choose to implement. ![]()

Type 1 Authentication: Knowledge Factors

Knowledge authentication factors are pieces of information that consumers know, do, say, perform or recall to verify their identities. Knowledge factors include personal identification numbers (PINs), passwords, and pass phrases. Consumers can prove they are who they say they are by knowing these secret words and numbers. Unfortunately, knowledge factors are the least secure type of MFA, primarily due to password fatigue. Because consumers maintain so many different online accounts, 61% choose to reuse passwords, making them much more vulnerable to cybercriminals.

Type 2 Authentication: Possession Factors

Possession authentication factors are physical items that consumers possess to prove their identities. Possession factors include passports, ID cards, smart cards, token devices, SMS codes, hardware keys, push notifications and time-based passwords. Possession factors are the most common form of MFA, and while some forms like email and SMS codes are not as secure as consumers would like to believe, other forms like time-based passwords and hardware keys are highly secure.

Type 3 Authentication: Inherence Factors

Inherence authentication factors are information based on a consumer’s physical and biometric characteristics, like fingerprints, facial geometry, iris scans, retina scans, palm scans and voice verification. Because inherence factors are based on parts of the human body, are unique to each individual and cannot be guessed, replicated, or stolen by criminals, they serve as very strong identity verification factors.

Type 4 Authentication: Location Factors

Location authentication factors are lesser known but highly effective methods of identity verification. Location factors are based on a consumer’s physical location and include IP addresses, media access control (MAC) addresses and mobile geolocation. Using a consumer’s devices to determine their location and determine whether they should be given access to platforms and accounts is an effective method of identity verification.

Type 5 Authentication: Behavior Factors

Behavior authentication factors are the most underutilized identification factor in fraud prevention. Behavior factors are based on a consumer’s behaviors and actions, including pattern unlock sequences, typing speed, speech patterns, mouse movements, gestures, signatures and keystroke dynamics.

Prioritizing the protection of your digital identity through MFA, strong passwords and cautious online behavior helps minimize the risk of identity theft and unauthorized access to sensitive information. You can make sure your business is ready to combat digital fraud by assessing how your current methods of authentication could be strengthened. EVS offers robust, flexible solutions to help businesses secure digital identities. When you partner with EVS as your fraud prevention and compliance provider, you’ll gain access to our expert fraud prevention cloud platform that integrates directly with your existing API. Learn more about how EVS can secure your company’s digital identity by requesting a demo or connecting with our team.