Just when you thought you’d covered all your business bases and protected yourself from cybercrime, a new leader emerges from the pack: synthetic identity fraud. What could possibly be worse than real data being stolen and used illegally, you ask? A combination of real and fake data that’s called synthetic fraud, and it’s currently on the rise in the digital world.

Unlike more traditional forms of identity fraud where a consumer’s credit card is stolen, bank account is compromised, or their identity and personal identifying information is stolen or compromised, synthetic fraud combines real and fake information to create false identities – literal fake humans – or it uses real information from multiple people to create a singular false identity, steal funds and wreak havoc.

Whether your business has fallen victim to this crime yet or not, the truth of the matter is that you could very well be a fraudster’s next target. Let’s get your brand protected before a cybercrime compromises your business and has you doing months of damage control. In this blog we’ll explore how identity fraud happens, why it’s so pernicious, and how EVS has developed proven solutions that can help you prevent identity fraud before it happens.

Uncovering the Secret World of Synthetic Identity Fraud

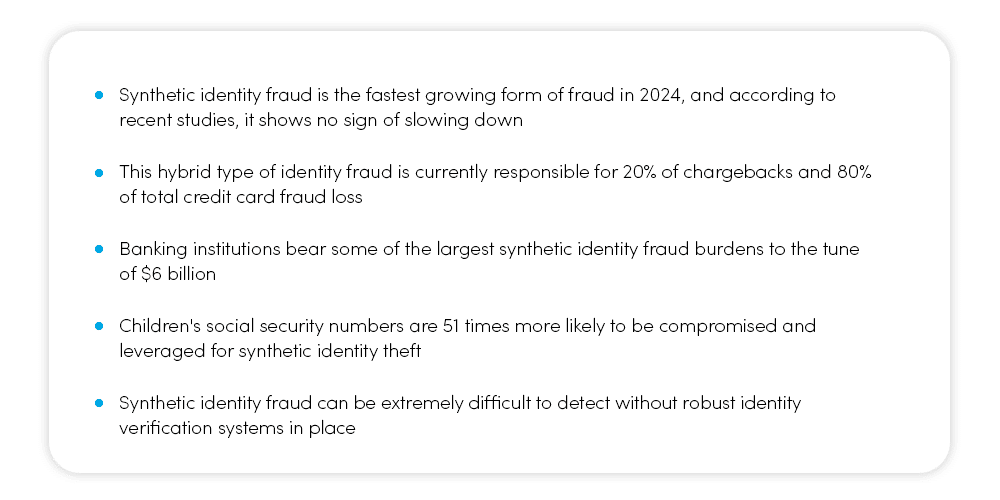

Data breaches are some of the biggest culprits in this nefarious game, because they give fraudsters access to huge swaths of consumer information. Last year alone, data breaches increased by 15% and put 54% of global customers at risk of digital identity fraud. Unfortunately, this statistic isn’t isolated:

How Does Synthetic Identity Fraud Occur?

A high percentage of the time, synthetic identity fraud begins with social security numbers. Cyber criminals steal social security numbers from common targets like financial institutions, loan providers, and credit card companies, then pair this information with made-up names, birth dates, and addresses, and viola: A “synthetic” person is born, and suddenly they’re opening lines of credit that will never be paid back. Some of the most recent synthetic theft cases revealed that criminals are also using randomly chosen social security numbers from the same range of numbers the Social Security Administration uses when issuing SSNs.

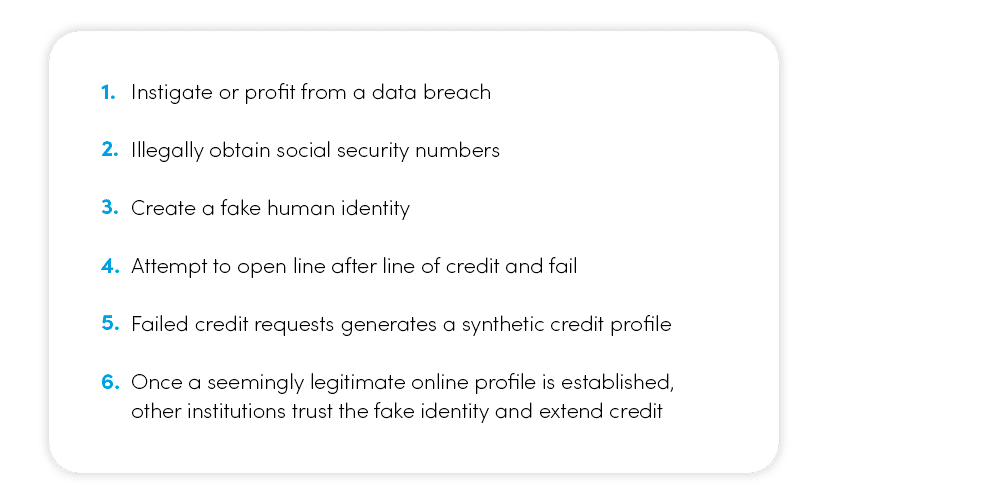

At this point you might be wondering, and rightfully so, why are businesses granting lines of credit to “human” accounts that have no digital footprint? Haven’t they done their due diligence to flag fraudulent accounts like these? The answer is a complex “yes and no.” To explain, here’s a typical day in the life of a synthetic identity fraudster:

Because a single, real consumer victim doesn’t actually exist in these fake identities, synthetic identity fraud is extremely difficult to detect, much more so than traditional identity theft. In fact, due to the cobbled-together nature of synthetic identity fraud, this crime is often referred to as “creating Frankenstein identities.”

To complicate matters even further, some cybercriminals don’t cash out their fake credit as soon as they receive it. Criminals can easily keep their fake accounts open for long periods of time, and because there’s little to no paper trail along the way (only repeated denied credit attempts used to build a digital footprint), businesses are hard-pressed to find ways of documenting evidence of criminal activity. Instead, they play the long game, slowly increasing their credit limit over time. Then one day, they max out their potential entirely, ditch their synthetic identity, and stick creditors with thousands of dollars of loss.

The High Price of Synthetic Identity Fraud

The obvious flipside of cybercriminals making large financial gains from synthetic identity fraud is that financial institutions and businesses are hemorrhaging money in losses. With billions of dollars at risk and unpaid debts from fake consumers piling up each year, today’s companies can’t afford to be complacent. Without proper identity verification on board, brands of every industry and size are at high risk of these damages:

- The financial loss of unpaid defaulted loans

- Compliance fines and fees

- The cost of installing new identity verification systems to mitigate future problems

Keep in mind that synthetic identity fraud creates a new human that isn’t legitimate, but it begins with a very real human and their personal social security information. Because of this link, synthetic identity fraud can also have devastating consequences for consumers, particularly our most vulnerable groups like children, the elderly, and the unhoused.

Fight Back with Proven EVS Solutions

Now is the time to take control of your brand’s online security with proven, reliable identity verification systems and synthetic fraud prevention solutions. EVS developed a line of robust identity verification and fraud prevention tools that can help your business combat this increasingly common form of fraud and reduce its risk of financial crime.

With more than 24 years of experience helping businesses in high-risk industries prevent fraud and drive revenue, the EVS suite of solutions can help your business detect synthetic fraud early, reduce financial losses, enhance customer trust, and provide a seamless and secure customer experience. We use 5000+ data sources to cross-reference consumer data and make sure you know exactly which real-life customers you’re dealing with.

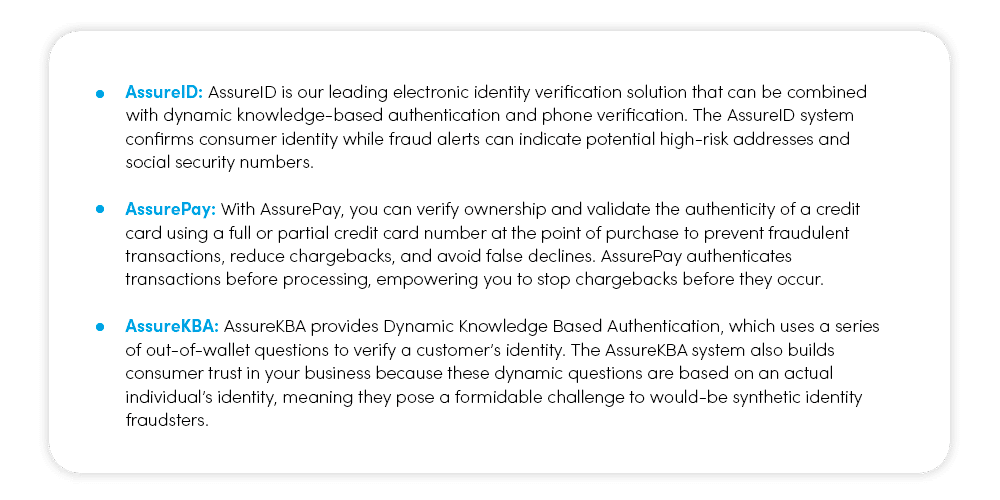

Create your bespoke identity verification system by starting with one or more of our EVS solutions:

Benefits Beyond Fraud Prevention: Creating the Custom Electronic Verification System You Need

EVS has decades of experience in fraud prevention and identity verification and offers multiple solutions that can help fight synthetic identity fraud, such as the AssureID, AssurePay, and AssureKBA solutions outlined above. These solutions work together within our proprietary BlueAssure platform to offer benefits that extend far beyond fraud prevention, including direct API integration for a seamless customer experience. Contact EVS today for a free consultation where you can learn how we can help your business fight the growing threat of synthetic identity fraud and keep you secure even as fraud techniques continue to evolve.