As fraud tactics evolve, e-commerce merchants are forced to increase and enhance their online payment fraud prevention strategies. Without proper protection, e-commerce sites will continue to be attacked, costing both companies and customers billions of dollars in loss.

According to a Juniper Research study, merchants are at risk of losing $24 billion to e-commerce fraud by 2024. Fraudsters and bad actors are constantly developing new ways to execute sophisticated attacks across industries.

These attacks typically come in the following forms:

- Identity theft: Also known as payments fraud, identity theft happens when criminals steal a user’s personal information, including credit card numbers, home addresses, email accounts and social security numbers, and uses it to make unauthorized purchases. The stolen goods may then be resold for a profit.

- Account takeover: Identity theft may also lead to account takeovers, where criminals use stolen credentials to steal loyalty points, drain financial resources or access other private user information.

- New account opening fraud: Criminals open new accounts or subscribe to services under stolen identities to make purchases or qualify for free trials, new-user perks or other discounted services.

- Chargeback fraud: Customers request refunds for purchased merchandise, claiming the products were damaged in transit or never delivered. Also known as friendly fraud, chargebacks force merchants to either redeliver, refund or pay a chargeback fee to the customer’s issuing bank.

- Refund fraud: Fraudsters and opportunistic consumers alike make use of refund fraud by claiming that purchased items never arrived, arrived without all its components or arrived damaged to abuse a merchant’s refund policies.

- Billing fraud: Criminals use a customer’s billing address to make unauthorized purchases that are then shipped to an address where the criminal can pick up the merchandise.

- E-gift card fraud: In this type of fraud, criminals use stolen personal information to purchase e-gift cards, which they can either use themselves or resell for profit.

- Triangulation fraud: Fraudsters create illegitimate websites and e-commerce stores to sell fake merchandise to unsuspecting customers, allowing them to steal customers’ money and credit card information. Fraudsters then forward the transaction to the legitimate merchant, who charges the consumer a second time. Triangulation fraud then often leads to chargebacks, resulting in even greater financial loss to the merchant.

Not only can fraud significantly impact a merchant’s revenue, but it can also seriously damage a business’s brand and reputation. Consumers may not be aware of the many fraud tactics that cybercriminals employ, but they are savvy enough to keep their distance from merchants that regularly succumb to e-commerce fraud. In fact, a 2020 customer retail experience survey found that 83% of consumers are more likely to shop on sites that discuss their fraud-prevention efforts, and 56% care more about e-commerce fraud prevention than online privacy. This means that one of the most important factors in protecting your business and your customers from the devastating financial and reputational effects of fraud is investing in a trusted method of credit card verification.

Not only can fraud significantly impact a merchant’s revenue, but it can also seriously damage a business’s brand and reputation. Consumers may not be aware of the many fraud tactics that cybercriminals employ, but they are savvy enough to keep their distance from merchants that regularly succumb to e-commerce fraud. In fact, a 2020 customer retail experience survey found that 83% of consumers are more likely to shop on sites that discuss their fraud-prevention efforts, and 56% care more about e-commerce fraud prevention than online privacy. This means that one of the most important factors in protecting your business and your customers from the devastating financial and reputational effects of fraud is investing in a trusted method of credit card verification.

What is credit card verification?

One highly effective method of recognizing and stopping e-commerce fraud is robust credit card verification. Credit card verification is one component of the payment process that uses a combination of data to validate real customer identities. There are four main types of credit card verification:

- Online PIN, which requires cardholders to enter personal that are then authenticated and approved.

- Offline PIN, which allows a transaction terminal to authenticate a PIN.

- Signature, which can be used in place of a PIN.

- Consumer Device CDCVM, which uses passcodes, fingerprints or facial recognition features to authenticate and approve transactions from customers’ personal devices.

identification numbers (PIN)

How can I protect my business from fraud?

While following basic e-commerce best practices can provide a basic level of fraud protection, the best way to fight e-commerce fraud is to proactively invest in a robust credit card verification system. Internal fraud prevention teams and software are prone to human error and difficult to scale as your business grows, but working with a verification partner is a more accurate and efficient way to protect your business. For merchants, a credit card verification system protects company time, money and resources. For customers, card verification ensures that your information is safe—not being exploited by fraudsters.

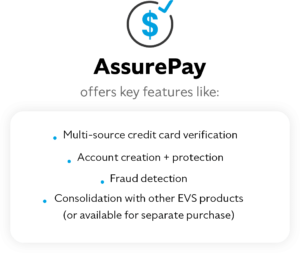

EVS offers a revolutionary credit card verification solution: AssurePay. Instead of waiting until payments are held for processing, AssurePay verifies consumer credit card information with consumer data at the very beginning of the payment process. Verifying cards so early in the purchasing process enables merchants to reduce false declines, fraud, chargebacks, manual reviews and operating expenses while simultaneously building consumer trust.

Not only will a reliable system enhance the safety of your business, but it will increase the felt sense of safety with your customers. AssurePay from EVS can help your business assess the digital fraud landscape and protect your e-commerce from all sides. To learn more about how AssurePay or other EVS identity verification products can protect your business from e-commerce fraud, visit our website or contact the EVS team.