First-party fraud, sometimes called friendly fraud, is anything but friendly to merchants and payment processors alike, and it’s a growing problem. Current research confirms that U.S. businesses lose a combined $50 billion to $100 billion every year to first-party fraud crimes, and that number could continue to climb as cybercriminals scale their efforts and deepen their reach. On top of this massive financial loss, businesses are also at risk of severe reputational damage and loss of trust from their customers.

It can be tempting to assume that your business will never fall prey to first-party fraud attacks, but sadly and statistically, that’s just not true. If the umbrella term of first-party fraud is a bit too vague and you’re curious how this crime might be affecting your business, it’s time to take a closer look. EVS is dedicated to helping our clients protect their businesses and prevent fraud with robust first-party fraud solutions. In this blog, we’ll cover different types of first-party fraud, steps you can take to prevent it, plus our own proven solutions to that can empower your business to stop chargebacks before they occur, without compromising the customer experience.

What Is First-Party Fraud?

If you run any type of business, no matter its size or scope, it’s critical that you understand how invasive and common first-party fraud can be. At its “best,” this type of crime can wreck customer relationships with your brand, and at worst, you’ll lose hundreds, thousands, or millions in revenue.

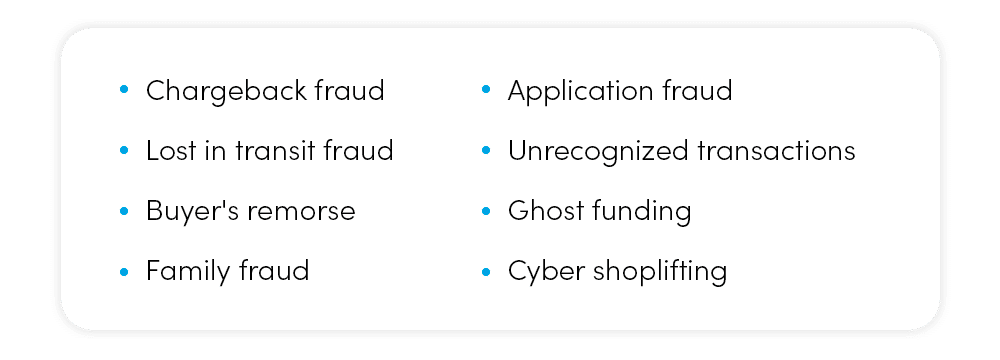

In its most basic form, first-party fraud occurs when someone intentionally misrepresents their own identity or falsifies information for financial or material gain. There are multiple types of first-party fraud, with these being some of the most common:

Every type of first-party fraud has the potential to cause direct financial loss through fees, lost revenue, and increased processing costs, not to mention the strain it can place on internal operations like customer service teams, the damage it can cause in brand reputation, and the bad karma it can create in your relationships with payment processors. Today we’re focusing on chargeback fraud, but many of the tips we’ll provide below can be applied across the first-party fraud system.

Chargeback Fraud & Its Most Common Causes

Chargebacks are one of the most common instances of first-party fraud. In the gambling industry, it’s known as gambler’s regret; the retail segment calls it payment disputes, and frustrated hotel guests may call it fair compensation for an unsatisfactory stay. No matter how it’s labeled, chargeback fraud can severely damage your business. The trouble is, some chargebacks are legitimate, while others are not.

Typical non-fraudulent chargebacks include everything from duplicate transactions and unclear or unfair refund policies to merchant names not being listed as expected on a customer’s billing statement. Shipping delays and out-of-stock merchandise might also lead a person to legitimately request repayment. Yet the vast majority of chargebacks are not innocent mistakes; they’re fraudulent crimes done with the intention of scamming a business.

Industry experts like Visa, Chargebacks911, and Expert Market explain that fraudulent chargebacks make up 75% to 86% of all chargeback occurrences, which means that a solid portion of these situations are intentional and need to be stopped. What’s more, a shocking 35% of American shoppers admit to engaging in first-party fraud, and 10% claim they have used this method of recouping funds more than once.

Illegal chargebacks are most likely to take place in e-commerce transactions, where a merchant can’t be present at point-of-sale and the business’s fraud prevention solutions aren’t strong enough to cope. If this sounds like you and your company, and you’re tired of falling prey to fraud, let’s get the ball rolling toward a healthier future with these fraud prevention steps.

Fraud Prevention Tips: How To Stop Chargebacks & Other First-Party Fraud

Prevent fraud: Sounds like a simple objective, right? Put the right systems in place and watch the number of fraudulent attacks on your business decline. Unfortunately, many businesses believe the measures they have in place are failsafe, when in reality they are lacking on many levels.

To help you bolster your company’s first-party and chargeback prevention, here are a few of EVS’s favorite first-party fraud solutions that you can start implementing today. They won’t be the entire answer to fraud prevention – we’ll discuss those below – but they’re certainly important pieces of the puzzle:

Proven Chargeback & First-Party Fraud Solutions: The EVS Product Lineup

If you’re ready to make your fraud prevention as airtight as possible and you’ve already incorporated the four tips above, consider adding EVS’ suite of first-party fraud solutions to the mix. Our signature solutions help businesses prevent fraud and drive revenue, all while helping them maintain compliance and avoid penalties, fees, and financial loss.

EVS has more than 24 years of experience helping businesses like yours prevent fraud and drive revenue with our signature solutions like AssurePay, AssurePhone, and AssureID. Every EVS solution integrates seamlessly with our bespoke BlueAssure platform and your existing operating system, so you can feel confident about the way you do business.

Now is the time to review your fraud prevention strategy, see where you need the most support, and contact EVS to find the first-party fraud solutions you need. Protect your business and your bottom line by proactively stopping chargebacks and first-party fraud. You could save your business thousands or millions of dollars in revenue and years of reputational damage.

Reach out to the EVS team to learn more about how our solutions prevent fraud and safeguard your resources.