In a recent study conducted by Javelin Strategy and Research, it

reflected that identity fraud has increased 13% from 2011. One contributing

factor to this increase may be due to the number of online payments and Internet

fraud. As discussed in A

Faceless Society Needs KBA, more consumers are using online transactions

as a part of their daily routine. Whether it be online shopping, online

banking, or even taking polls and/or entering sweepstakes, if you are entering

your personal information online you run the risk of someone else accessing it.

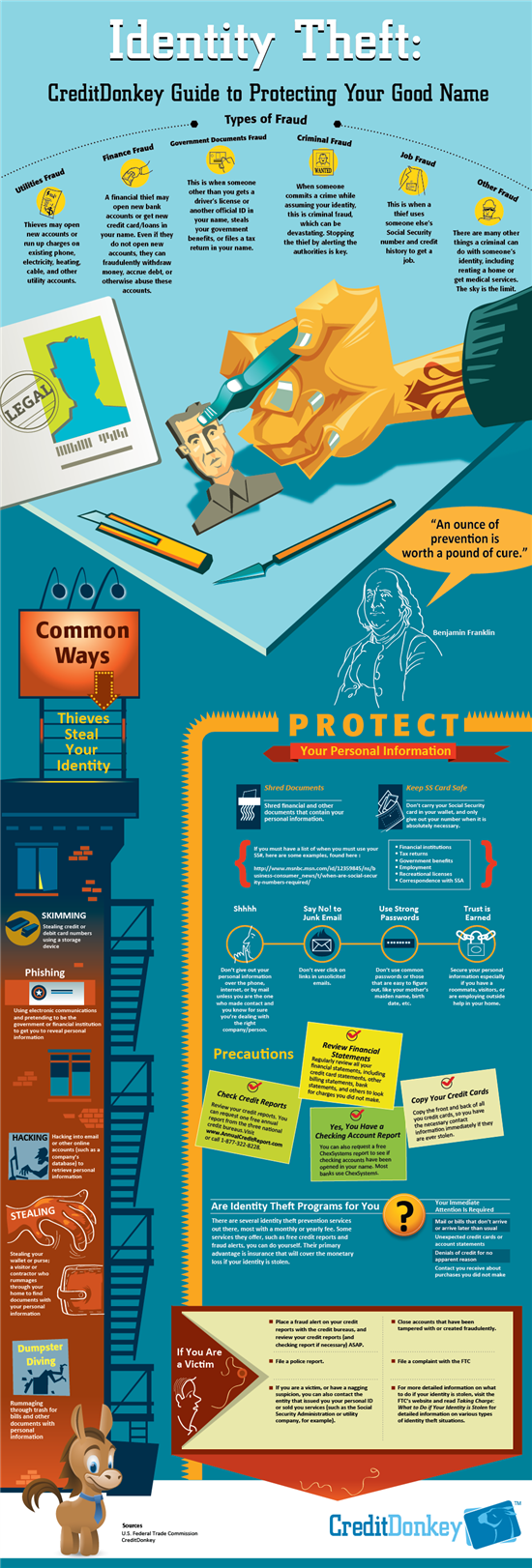

In an infographic issued by CreditDonkey,

they help to illustrate the different types of identity fraud and give tips on

how to avoid it.

One way to help ensure the safety personal

information online is the use of ID

verification and authentication. Businesses who help to protect their

consumers information, such as financial institutions and online retailers,

need to consider partnering with an ID verification provider to strengthen

their fraud

prevention measures. EVS helps to ensure that someone is who he or she

claims to be when entering information online. This helps to protect against

thieves using stolen personal information. ID verification and authentication

is the key to cutting down on identity theft online. As more companies

integrate this service into their security measures, consumers will be further

protected from online identity theft and Internet Fraud.