The digital revolution is almost in full-swing and consumers

are logging in online to handle everything from shopping to personal financing.

As more consumers are creating online accounts to carry out daily tasks,

businesses must keep up with this trend. From social media to mobile apps, businesses

are doing everything they can to keep their head above water during this online

revolution. With consumers and businesses are making the transition online,

one of the biggest concerns both parties have is with online security. In

an infograpahic

created by BT.com, it outlines usage of financial institutions online. Forty-four

percent of financial institutions are using more than four providers and 66% of

consumers consider themselves very to extremely concerned about security of

their personal information online.

As the increased of usage of financial institutions online

rises, companies must apply fraud

prevention systems to protect their users. Even though most people are

using four or more providers online, 43% of these financial institutions are

only using one token of authentication.

This can raise some concerns for online users who are weary

of sharing their personal information online. So why arent companies using

better and more identity verification and authentication? Companies want

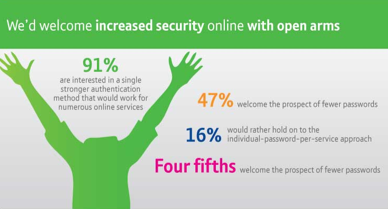

simple, effective fraud prevention solutions. Ninety-one percent of companies

want a single, stronger authentication method for online services. Companies need better online security, but are wanting a single solution. By implementing real time

identity verification and authentication, companies can help prevent

fraudulent activity on their platforms. Once companies can provide this

security for their consumers, they will be more likely to use the online

platform freely without concern.

[Contributed by EVS Marketing]