As deeply as we wish money laundering wasn’t a massive issue and that robust AML tools weren’t necessary, that’s simply not the reality of today’s digital landscape. Not only does money laundering affect large financial institutions, but it has its criminal claws in every industry, from law firms and real estate offices to gambling platforms and payment providers.

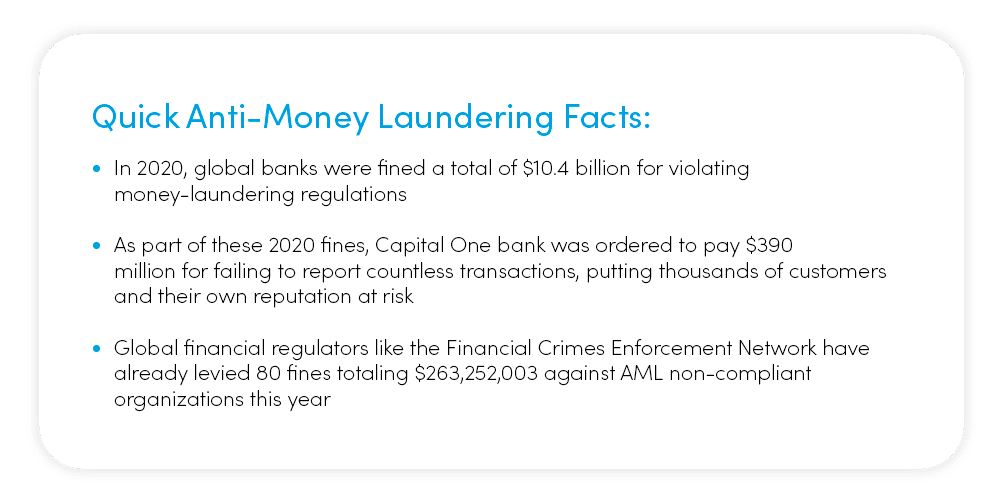

With so many businesses at risk and nearly $300 billion laundered in the U.S. each year, today’s businesses must take steps to increase their fraud detection capabilities and improve financial security for their customers. If proper anti-money laundering systems aren’t in place, companies risk leaving customers open to financial loss and incurring huge fines if transactions and other illegal activities aren’t reported properly.

If you own a business of any size, anti-money laundering tools and protections need to be an integral part of your arsenal. Dive deep into the world of fraud detection and AML software with this comprehensive review. We’ll take a closer look at how and why money laundering criminals strike, what the government does to combat money-laundering violations, and how professional anti-money laundering services like EVS can provide your business with the AML solution it needs to maintain its financial security.

Money Laundering 101: How & Why This Crime Occurs

Although popular shows like Breaking Bad and Ozark have sensationalized money laundering in recent years, the truth is that this crime is highly dangerous for businesses and consumers. Money laundering is, when you cut through all the jargon, a way for fraudsters and bad actors to hide the origins of illegally obtained money. It typically coincides with other high-level crimes like embezzlement or terrorism financing, and it can be extremely difficult to detect.

Cash-intensive business covers: Criminals often use cash-intensive businesses, or companies that receive a significant amount of their receipts from cash payments, to mix their illicit proceeds from illegal crimes and hide them from view. These companies include convenience stores, retail locations, liquor stores, and parking garages.

Smurfing: Though its name might sound comical, the practice of smurfing is anything but funny. Smurfing is the illegal financial practice of dividing large amounts of money into multiple smaller transactions to avoid detection and regulatory penalties. This crime can affect a range of industries, including online gaming and financial institutions.

Ghost company covers: Money laundering criminals might also create ghost companies, or fake businesses that have no real employees or office. More commonly known as shell corporations, ghost companies help fraudsters hide illegal financial activity, avoid regulatory investigation, and lower their taxable income.

High-value asset takeovers: High-value assets, or HVAs, are integral information systems or chunks of data that, when hacked or compromised, cause an organization to malfunction. Once money-laundering criminals corrupt this information, companies lose their ability to conduct business as usual. HVA attacks can affect every industry, from energy and utilities to manufacturers and insurance companies.

Governmental Oversight: How AML Laws Combat Money Laundering

First enacted by the Financial Crimes Enforcement Network, the Bank Secrecy Act of 1970 established laws for recordkeeping and reporting by individuals, banks, and financial institutions. The Bank Secrecy Act continues to be one of our most important AML tools in the fight against fraud, but additional laws have been passed between 1970 and present day to combat new criminal activity and help bolster financial security for customers and businesses alike.

Complying with federal and state anti-AML laws might feel like an unnecessary hassle at times, but their presence can save companies millions or even billions of dollars in lost funds or compliance violations.

You can keep your business safe from federal or state compliance violations by following an AML compliance program. Multiple online resources give detailed information about AML compliance as established by the Bank Secrecy Act, but here’s a brief overview to get you started.

AML Compliance Program Steps:

- Integrate a robust internal system to protect your business from fraud attacks

- Perform regular, independent compliance testing

- Designate a BSA compliance officer within your company to oversee daily compliance

- Ongoing anti-money laundering training for employees

- A risk-based identity verification system to authenticate customer identities

- Ongoing Know Your Customer (KYC) assessments

How EVS Can Help: BlueAssure Is the Robust AML Tool You Need

If the anti-money laundering facts and AML compliance steps above have your head spinning, don’t stress. Professional compliance solutions companies like EVS make it their mission to help protect your business from money-laundering attacks, incorporate comprehensive fraud detection systems, and use high-level AML tools to mitigate risk.

How does EVS manage to hit these goals and keep its clients safe, you ask? The answer is simple, and so is the process of integrating our products. EVS developed a full suite of signature AML products that can help your business maintain regulatory compliance while also driving revenue. Our strong, compliance-based systems can be layered seamlessly within our customizable BlueAssure platform so clients can create a bespoke solution that works for their needs.

Get started today with our anti-money laundering solutions and see how quickly and seamlessly they can add financial security for your company. Start with a snapshot of our most popular AML software – AssureID and AssureWatch – then reach out to the EVS team for a closer look at our bespoke AML tools.

AssureID: With AssureID, clients get top-quality identity verification and fraud prevention in a single solution. AssureID is a very popular choice among EVS clients because of its ability to cross-reference multiple data sources within seconds, verify a consumer’s identity in a single transaction, and identify high-risk individuals and provide notice of fraudulent activity.

AssureWatch: Our clients often pair AssureID with AssureWatch to form a more compliance AML compliance solution. AssureWatch is a watch list and sanctions screening tool that enables businesses to cross-reference customer data across multiple government sanctions, perform PEP listsscreening and Adverse Media scrubbing to maintain AML compliance and lower their money-laundering risk significantly.

AssureID and AssureWatch operate within our proprietary BlueAssure platform to provide comprehensive fraud prevention and meet regulatory compliance requirements. The great news is, BlueAssure was purposely designed to allow for easy integration through our intuitive API’s, so you’ll enjoy frictionless onboarding, increased AML compliance, and stronger fraud detection when you partner with us – all while our EVS products also help you drive revenue.