Buy Now Pay Later (BNPL) platforms are tempting for even the savviest consumers, which means BNPL fraud is even more tantalizing for today’s canny criminals. While it may feel like new types of digital fraud are cropping up left and right, this illicit form of thievery has been around for nearly 15 years and shows no sign of stopping.

Individual shoppers love the flexibility of BNPL payment plans, big-name merchants like Amazon, Apple, and Squarespace sell products through BNPL services like Klarna and Afterpay, and the system works beautifully…until fraudsters take control. In this blog, we’ll discuss the rise of this criminal activity and how EVS solutions can successfully help businesses protect themselves and their bottom lines with robust payment fraud prevention that’s still lightning fast and streamlined.

The Allure of BNPL and its Rapid Growth

BNPL is a type of short-term financing service that enables consumer purchases over time. The concept isn’t new: If you’re of the Millennial generation or older, you’ll likely recognize the BNPL structure as a type of layaway that chain stores used to offer, particularly before holidays.

Today’s BNPL services are more advanced but still provide a clear path toward ownership for consumers who can’t afford the full price of an item up front. Best of all, BNPL allows people to take products home right away, rather than waiting until the full purchase price has been remitted. Many people have come to rely on BNPL as an alternative to credit cards, and we see the most BNPL usage in online shopping. The trouble is, this personal convenience for consumers also turns out to be a convenient avenue for criminals, offering them a new way to defraud businesses.

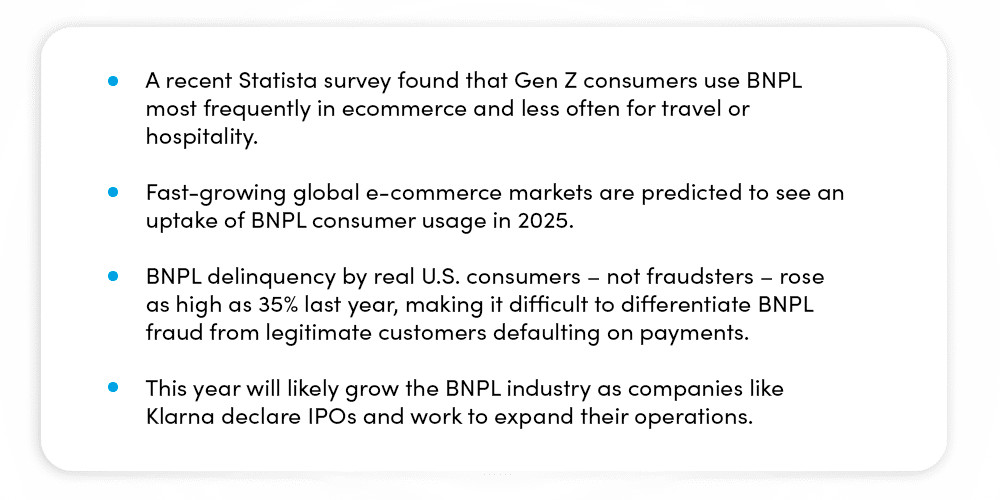

Quick Facts About Buy Now Pay Later

BNPL Fraud: How and Why This Crime Works

It sounds too simple to be true, but BNPL fraud works very similarly to account takeovers, synthetic identity crimes, first-party fraud, mule accounts, and chargebacks. Creative fraudsters exploit the BNPL system by creating new accounts with stolen identities or by taking over existing accounts with stolen personal data.

They take advantage of the leniency during the account opening process, often bypassing identity verification checks. These bad actors then place orders, knowing full well they won’t ever pay more than their initial BNPL payment. Some cybercriminals double down on BNPL fraud by not only placing unscrupulous orders, but also claiming to have never received their products and file chargebacks against merchants.

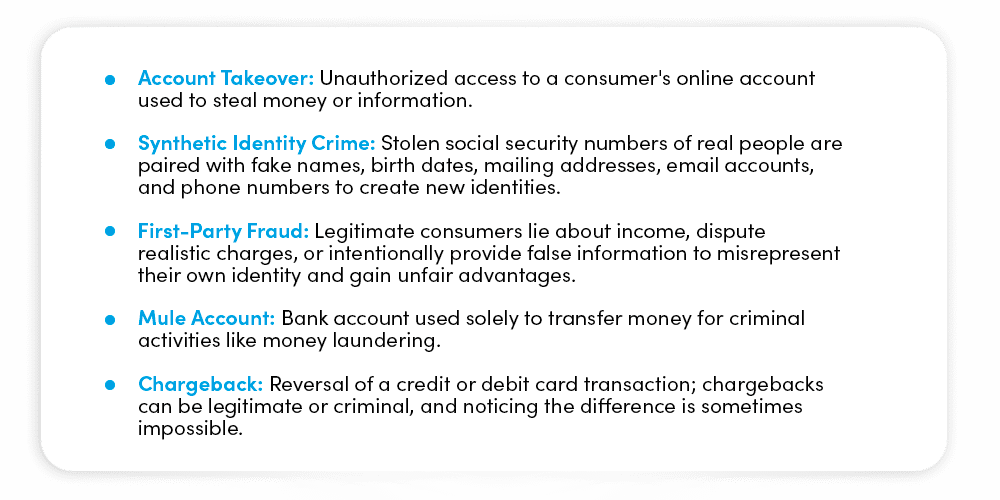

Types of BNPL Crimes

The Unique Challenges of BNPL Fraud

Today’s digital shoppers want a click-and-pay system, even in BNPL scenarios. Add to cart, double-check the shipping address, and purchase. They expect the process to take seconds, and if it doesn’t, there’s a high chance they’ll abandon their carts to shop elsewhere. More specifically, there’s a 69% to 75.5% risk of any given potential customer “walking away” if checkout takes too long or involves too many steps. The simple solution here, it would seem, is to integrate the fastest possible BNPL services with instant approvals…right?

The trouble is, BNPL services that prioritize speed make fraud detection much more challenging, and the risk of severe consequences much more prevalent – for you and your customers. Here’s how:

- Unauthorized BNPL transactions and subsequent defaults can significantly impact consumer credit scores.

- Lower credit scores make it challenging for people to secure credit cards in the future, therefore limiting their spending power.

- Since BNPL traditionally requires limited credit checks, fraudsters are free to take advantage of lenient approval processes.

Given these results, the entire concept of a fast yet secure BNPL process might seem impossible, but it’s not. It just needs to be handled with care. True BNPL fraud protection balances fraud prevention with a seamless customer experience, keeps customers happy and purchasing, and elevates your profits.

Strengthen Your BNPL Fraud Defenses With EVS

EVS offers a comprehensive suite of identity verification solutions that rely on multiple data-driven sources to provide fast, highly accurate verification of your customer’s identity. You can effectively prevent payment fraud through our bespoke system; here’s a brief overview of our most relevant solutions:

- AssureID: Robust identity and age verification

- AssureCard: Driver’s license or passport validation

- AssurePay: Payment verification and chargeback prevention

- AssureFill: Accurate, quick auto-filling forms

- AssurePhone: OTP two-factor phone verification

How EVS’ Tailored Solutions Help Drive Revenue

Plus, BlueAssure give you the ability to layer our products and create bespoke fraud prevention solutions, along with the industry’s most customizable controls. And with direct API integration, you can offer a seamless consumer experience without compromising your own security. Reach out to EVS today to learn more about how we develop tailored solutions to protect your business from BNPL fraud without sacrificing speed or convenience.

BNPL provides unique challenges for retailers who want to protect themselves from risk while still providing a fast, frictionless customer experience. EVS offers a comprehensive suite of identity verification solutions that can help retailers prevent fraud while driving revenue. Our signature BlueAssure platform was literally designed to give retailers the extra protections they need in this world of BNPL fraud and bad actors.